Increasingly, during and post pandemic, more and more travelers think it’s important to choose the right travel insurance, and if needed, it’s equally important to know how to file claims. We are sharing these tips on choosing travel insurance and filing claims based on our personal experience, to help you get the maximum reimbursement you deserve!

Travel insurance wasn’t always at the top of our list during vacation planning. However, our perspective has changed after traveling a few times during the pandemic.

While most countries were still having Covid entry restrictions, we took advantage of the dirt cheap airfares, and visited many places. You might ask why we were willing to take the risk of getting infected by traveling. Well, we were all always up-to-date on our Covid vaccine status, plus compared to New York City where we lived, other places we wanted to visit had a much lower infection risk.

Even though we were not worried about getting seriously sick, we did consider the possibility of getting stranded in a foreign country and not able to come back due to a positive test result. Therefore, we decided to look into purchasing travel insurance which covered Covid related expenses.

Understanding how to choose the right policy and file claims became an important part of our vacation planning. I would like to share with you some tips on choosing travel insurance and filing claims, from our personal experience.

Our stories

Spain – Medical Coverage Claim Filed

Our summer trip to Europe in 2021, was the first time we took out travel insurance. The policy cost about $180 for the three of us. It had $150,000 primary medical and $2,000 trip coverage per person.

While visiting Valencia, our second city in Spain, my partner woke up with sudden extreme pain in his abdomen. We suspected it was a small kidney stone, so at 6 o’clock in the morning we called the medical emergency hotline provided by the insurance policy. The staff picked up the phone right away and recommended a near-by English speaking hospital.

We immediately took a cab to their emergency room. Fortunately, after a few hours of I.V. fluid drip and pain medication, my partner felt better. We were able to enjoy the rest of our trip. The insurance company staff had already filed the claim for us on the same day.

Once we got back to the U.S., we submitted all our receipts. We got all the medical cost of about $900 reimbursed within a few weeks.

Rio De Janeiro – Trip Coverage Claim Filed

Since we had such a good experience with them, we purchased the same policy from the same company for our following trip to Rio De Janeiro, for New Year’s Eve, 2022.

We were all boosted and up-to-date with our Covid shots, but the new Omicron variant was just starting to spread.

On the day before our planned return flight, two of us tested positive. Our only symptoms had been minor stuffy noses for a couple of days, that we thought were allergies. A negative test result was required at that time, to come back to US. Fortunately, we were able to quickly get a nice affordable Airbnb, and work remotely for two weeks.

Even though the policy stated it would only cover 7 days post our scheduled return day, we kept all the receipts, and filed a claim for reimbursement of all 14 days of expenses, including our food, plus accommodations and business class return flight tickets.

We actually got reimbursed for more than we expected, at almost $6,000 for the 3 of us! It’s like having two more weeks of paid vacation in Rio De Janeiro!

So far, we have filed two claims out of the three trip policies that we purchased. Let me break these down and give you tips on choosing the right travel insurance, show you how to use their services and properly file claims.

Choose the best travel insurance company and policy – squaremouth.com

How did we choose our travel insurance policy? We started out with a Google search that gave us lots of links to individual insurance company websites, where we could compare all the policies offered by each company.

Many policy comparison sites looked very similar. Ultimately, we decided to use squaremouth.com to compare policies as it shows you different policies from different insurance companies in one place. It allows you to search against the criteria that fits your needs, and then displays the policy summaries, details and customer reviews.

Note the following tips when choosing a travel insurance policy:

1. Read the policy carefully in detail. The fine print matters!

If you don’t understand some of the details, call and ask. You will get help right away, as the sale person would love to help you.

2. Are Covid related costs covered?

As countries are easing Covid related travel restrictions, this might not be as important a factor now, but you might want to consider if it covers Covid related medical expenses anyway, just in case an infection occurs and you need to visit the local hospital.

3. Would you like to cover the cost of your trip, or just medical/dental?

We wanted to make sure if we were stuck in a different country due to a positive test, the needed expenses would be covered, hence we opted for both travel and medical costs. Covering the trip cost also ensured we would get reimbursed if there is a delay. However, adding the coverage of the trip cost usually raises the premium dramatically.

4. Is the medical coverage primary or secondary?

We always choose primary medical coverage, because it saves the hassle of filing claims first through your own primary health insurance company, if there is one. The secondary coverage only kicks in for the portion which is not covered by your own health insurance company.

5. How much of the medical and/or travel cost do you want to cover?

Medical coverage is really dependent on personal comfort level, but I wouldn’t go lower than 50K.

For the travel cost to be covered, you don’t need to be exact on all the travel expenses. Instead, consider how much of the “portion” you want to be covered. Say, if you pay $2,000 for hotel and $1,000 for your flights, and you want to just cover $2,000, then the maximum reimbursement will be based on $2,000, times a factor, depending on the policy. You can request to have the policy cover up to the maximum of the total you spend, but you will need to show all the receipts, if and when you need to file a claim.

6. How are the customer reviews for this policy/insurance company?

This is the part where I spent the most time, and was the most critical to me. Remember, you want to make sure the company has good reviews and responses not just on assisting you with the purchase of their policies, but also with help during the filing of claims.

Some insurance companies just want to make the sale, and when it comes to actually filing a claim, you can never get anyone on the phone. Making sure they have good reviews for claim filing is key. It’s also very important to have good reviews on emergency assistance.

The website square mouth.com not only provides a place to compare policies from different insurers, but also provides reviews on each policy and insurer. It’s a true one-stop-shopping experience for choosing your policies.

We used the a company called “Tin Leg”. They had very good reviews, and we sure were very satisfied on both claims we had to file with them.

7. What’s the cancellation/change policy of the insurance policy itself?

Sometimes you might need to cancel your trip. Can you also cancel the policy?

Print out all the documentation with contact info prior to travel

During an emergency, if you need to make a call and talk to someone on your phone, it’s much easier to find the phone number or refer to your policy number if it’s on paper in front of you. It’s also more convenient for looking up your policy details, instead of downloading a PDF, and trying to blow it up to view on your small device.

Reaching out for assistance while traveling

It’s important to keep the 24 hour hotline handy in case of an emergency. While my partner was having extreme pain at 6 AM in the morning in Valencia, Spain, we immediately called the hotline. The gentlemen picked up the phone right away, and noted our situation and location. It only took him a few minutes to give us a few options for nearby hospitals. He also had someone call us back to follow up later in the day, plus told us the claim had already been filed on our behave. We just needed to keep all our receipts, and submit them after we returned from our trip.

Again, the key is to look into their reviews, and make sure the insurance company has great ones for handling emergencies and filing claims.

Inform the insurer as soon as possible

You want to inform the insurer as soon as an incident occurs, so they will have a record on file. Some of those with good customer service, will even file the claim for you. Don’t keep the insurer in the dark, and then surprise them with a claim after you complete your trip.

Keep all receipts

It goes without saying, you need to keep all your receipts, including medical expenses, food, drinks, groceries, accommodations, transportation, and return flight tickets.

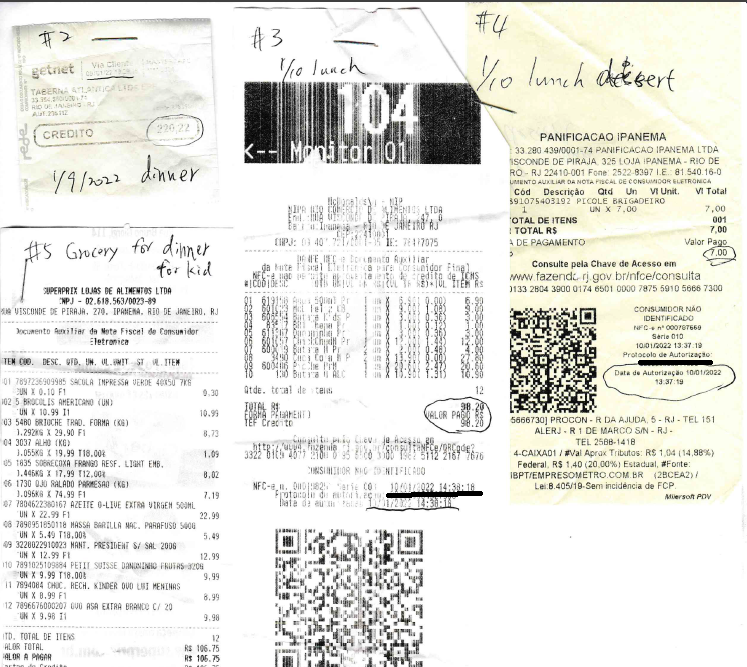

I just wrote on each, noting the dates and what each was for, like “dinner”, or “lunch” and such. Then threw them all in a big bag, and dealt with them after I returned from the trip. You don’t want to waste your precious vacation time organizing them.

Even though our policy mentioned the travel delay overage only covered a 7-day extension, post the original return date, the insurance staff actually told us to go ahead and submit all 14 days of receipts. So, keep all your receipts!

Organize all your paper work before submitting the claim

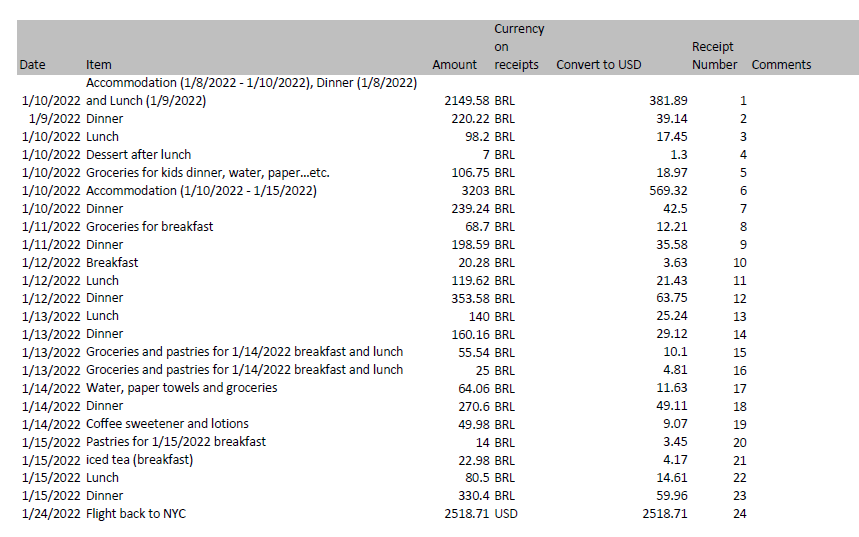

Personally, I think a little homework goes a long way. I organized my expenses by using Excel to itemize them, and based on the numbers on the list, wrote down each number on each corresponding receipt.

Then, I stapled the numbered receipts on sheets of papers for easier reference. The Excel sheet provided the itemized total expenses to be claimed.

I think the staff handling the claim did appreciated the extra work I had done. In the end, I filed the claim for 7 more days than the policy allowed, plus some other questionable items, such as Covid testing costs, and I was reimbursed for more than I claimed.

Summery of the Expenses:

As you can see below, I noted what the receipts was for as soon as I got them, so it would be easier for me to identify them after the trip. After they were itemized, I created a list of the corresponding numbered receipts, in the spreadsheet above.

Conclusion

Everyone, of course, wants a smooth and memorable vacation, but unexpected things can happen and you need to minimize the risk and damage to your long-planned holiday. Understanding how to choose the best travel insurance policy and how to prepare materials for filing claims has become an important part of our vacation planning.

The last thing you want during your vacation is to worry about unexpected medical expenses or the extra cost of delayed or interrupted travel. Even though countries all over the world are easing their Covid travel restrictions, it is still highly possible to get infected while traveling. Adding travel insurance can give peace of mind to your year-long planned holiday. Be sure to choose your policy carefully, from companies with great reviews for emergency assistance and claim handling.

It is important to know how to choose the right travel insurance policy to fit your needs, such as for medical only, or to also cover unexpected travel interruptions or delays. The coverage amount should be tailored to your financial needs and budget. It is equally important for you to understand how to organize your receipts to file claims. Following our tips on choosing travel insurance and filing claims can make your long-planned trip go much smoother, and to maximize the reimbursement you deserve, if there is an unfortunate incident.

We chose, for example, Tin Leg’s “Luxury” policy which only cost about $180 total for 3 of us. The first claim, we received approximately $900 of medical expenses reimbursed, and for the second claim, we were reimbursed about $6,000 for travel expenses! I couldn’t image having to pay that much additional cost out-of-pocket, if we hadn’t purchased the insurance.

Have you booked your hotels yet? If not, check out our tips to maximize savings on hotels bookings first!

The owner of this website may receive compensation for recommendations made in reference to the productions or services on this website.

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.